Federal Reserve Officials Signal Possibility of Another Big Interest Rate Cut

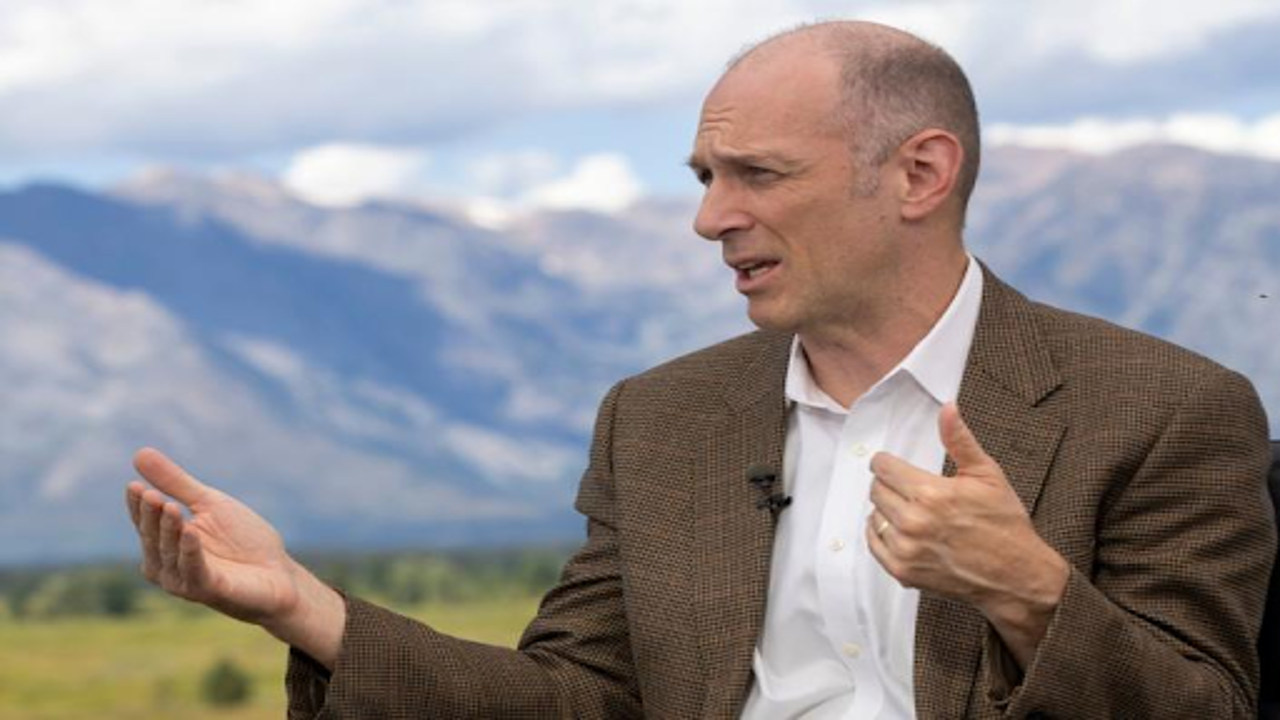

On Monday, several Federal Reserve officials suggested the possibility of further large interest rate cuts shortly, emphasizing that current rates still significantly impact the U.S. economy. Chicago Fed President Austan Goolsbee stated during a Q&A session that there’s a long way to go in bringing rates down to a neutral level, where they neither stimulate nor hinder economic growth. He emphasized that while the Fed has not yet committed to another large rate cut, future decisions will be driven by incoming economic data.

The central bank's next meeting is set to take place after the presidential election, on November 6-7. Goolsbee pointed out that the current benchmark interest rate is "hundreds" of basis points above the neutral level, which can only be estimated and not measured directly. He also expressed concerns that holding high rates for too long could eventually harm both employment and inflation levels, which are currently favourable.

Alongside Goolsbee, Atlanta Fed President Raphael Bostic and Minneapolis Fed President Neel Kashkari also expressed support for the recent decision to lower the benchmark rate by half a percentage point, placing it in the 4.75% to 5% range. However, the debate continues within the Fed about where the neutral rate lies, especially after the economic disruptions caused by the COVID-19 pandemic. While some believe the neutral rate has increased, it remains unclear whether this shift is temporary or permanent.

Bostic, while agreeing that the current rate is well above neutral, urged caution in how fast the Fed should move to cut rates. He suggested that any significant weakening in the labour market could influence his stance, though he didn’t advocate for aggressive rate cuts, favouring a measured approach.

Meanwhile, Kashkari argued that the resilience of the U.S. economy, despite high interest rates, might indicate that the neutral rate is higher than previously thought. However, he acknowledged that current monetary policy remains tight and supported cutting rates by a quarter-point at the remaining meetings this year. He also emphasized that economic data would play a key role in determining the pace of future cuts.

The ongoing debate within the Fed includes differing viewpoints from key figures such as Fed Governor Christopher Waller, who backed recent rate cuts due to favourable inflation data. Waller indicated he would likely support quarter-point reductions at upcoming meetings, though unexpected shifts in the labour market or inflation could change his stance. In contrast, Fed Governor Michelle Bowman voted against the recent rate cut, citing concerns about inflation remaining above the central bank’s target.

Goolsbee further argued that the Fed must act preemptively to avoid significant damage to the labour market. He pointed out that job losses can rapidly escalate, leading to a feedback loop of decreased spending and further layoffs, making it crucial to address potential issues before they fully materialize. With the unemployment rate having risen from 3.4% last year to 4.2%, Goolsbee noted that this level is consistent with full employment, but cautioned that waiting too long to act could jeopardize the Fed's goals.