Global stocks approach record highs as investors await Fed rate cut. Bloomberg

Global stock markets approached their highest levels on Monday, buoyed by the anticipation of interest rate cuts from the Federal Reserve. This positive sentiment helped push the MSCI All Country World index closer to a record high. Benchmarks in Australia and Hong Kong saw gains, reflecting the optimism.

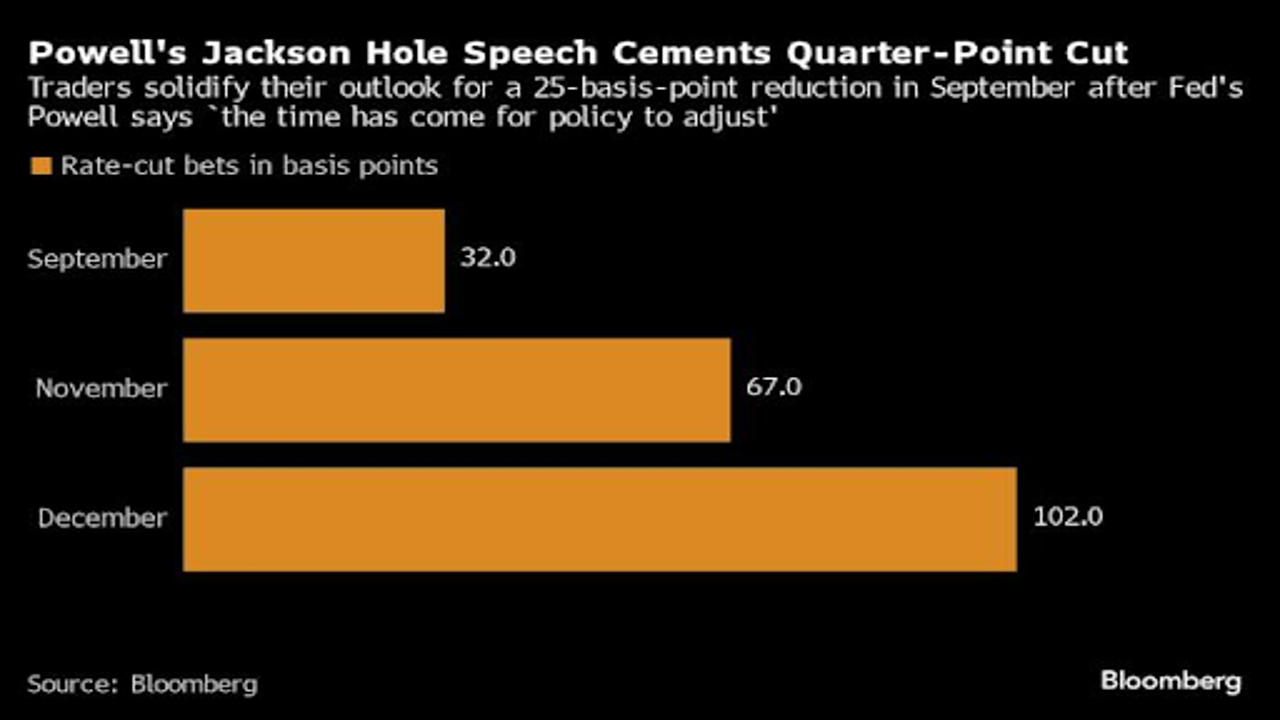

The surge in market confidence followed remarks from Federal Reserve Chair Jerome Powell, who suggested in a recent speech that the time was right to consider monetary easing. This dovish stance has not only boosted stock markets but also affected currency movements. The yen strengthened against the dollar as investors repositioned their bets on the greenback, which fell broadly. Despite this, Japanese stocks dropped due to the stronger yen, while U.S. and European equity futures showed some decline.

With expectations of lower U.S. borrowing costs, financial markets are experiencing a shift. The yield on 10-year U.S. Treasury bonds fell slightly to 3.78% on Monday, reflecting the broader market's anticipation of changes in monetary policy. "It should be risk-on," said Chamath De Silva from Betashares Holdings in Sydney. "Powell has confirmed that we’ll shortly be entering an easing cycle, and that the fight against inflation is done, so I expect a bit of an everything rally, stocks and bonds both performing well."

The rising tensions in the Middle East also played a role in the markets, contributing to a rally in oil prices, which increased by 0.7%. This came in response to an Israeli strike on Hezbollah targets in southern Lebanon, heightening concerns about further conflict in the region.

The Bloomberg Asia Dollar Index reached its highest point since January, with the Korean won and Singapore’s dollar gaining strength. This reflected traders' expectations of differences in monetary policy between local authorities and the Federal Reserve. Powell's comments at Jackson Hole indicated a significant shift in the Fed's approach to managing inflation, suggesting that interest rates may soon be reduced from their highest levels in over two decades.

Despite the cooling signs in the U.S. economy, experts believe a severe economic downturn is not imminent. Khoon Goh from ANZ Group Holdings expressed confidence in a “soft landing” for the U.S. and a strong rebound for Asian currencies during this Fed easing cycle.

In China, the People’s Bank of China held its one-year policy loan rate steady at 2.3% after a recent rate cut. The central bank is focusing more on short-term measures to manage economic growth amid weak demand and a rare contraction in bank loans. China has also begun stress testing financial institutions on their bond investments to ensure stability in case of market volatility.

In the commodities market, iron ore prices continued to recover as China’s inventory levels decreased, signaling a possible end to the oversupply situation. Gold prices steadied near record highs, buoyed by expectations of Fed rate cuts and ongoing geopolitical risks.

Key events to watch this week include U.S. durable goods orders, China’s industrial profits, and Germany’s GDP. Additionally, Nvidia Corp.'s earnings report and U.S. GDP figures will be closely monitored.