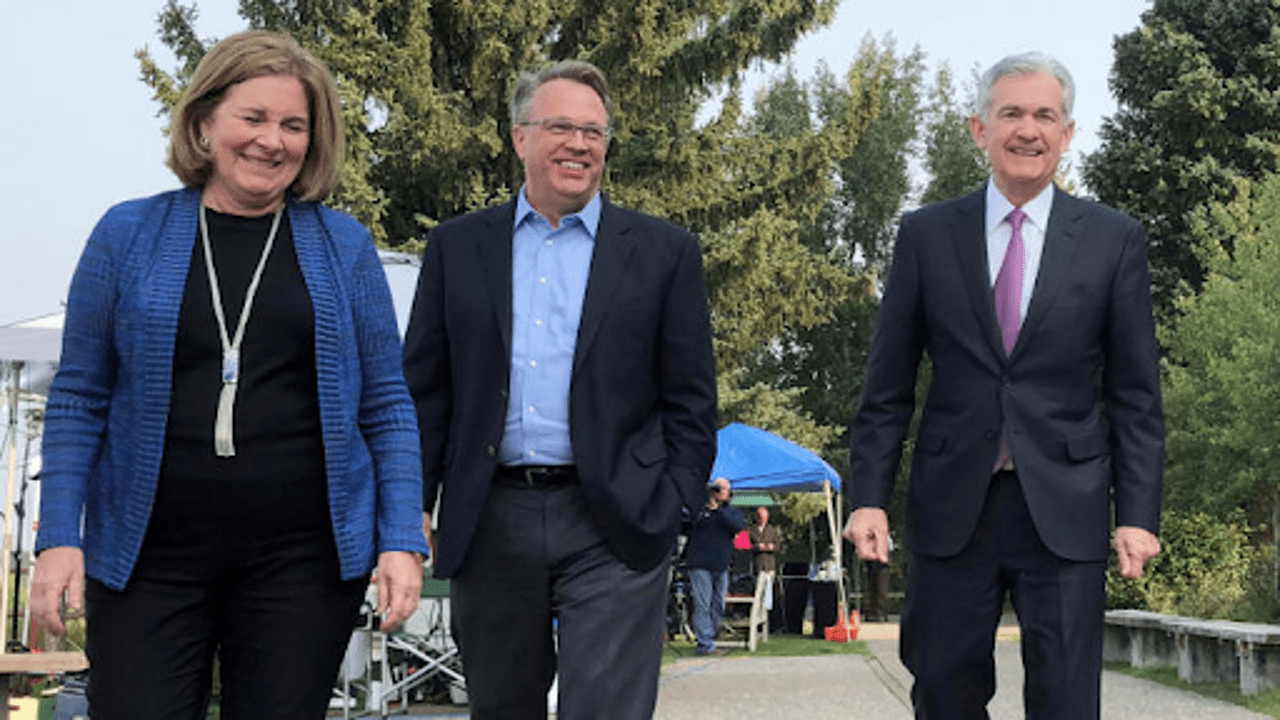

Federal Reserve Chairman Jerome Powell, Kansas City Fed President Esther George, and New York Fed President John Williams were photographed together at the Jackson Hole conference in 2018. The image was captured by Reuters photographer Ann Saphir.

Federal Reserve Chair Jerome Powell faces a different challenge at this year's Jackson Hole economic symposium compared to last year. The focus has shifted from the duration of high interest rates needed to curb inflation to how much the Fed will reduce rates as inflation cools and the job market slows.

On Friday, Powell will address these issues during a 10 am ET speech, where investors will eagerly listen for clues about the future direction of monetary policy. In a recent press conference, Powell hinted at a potential 25 basis point rate cut in September but downplayed the possibility of a larger 50 basis point cut. "The time is approaching, and if the data aligns with our expectations, a rate reduction could be on the table at the September meeting," he stated.

The tradition of gathering in Jackson Hole started over 40 years ago, initiated by the Federal Reserve Bank of Kansas City to entice then-Fed Chair Paul Volcker, an avid fly-fisherman. Today, this meeting attracts central bankers, academics, policymakers, and journalists from around the world, offering a platform to discuss economic and monetary policy issues. The event is held at Jackson Lake Lodge in Grand Teton National Park, a scenic setting that has become synonymous with pivotal economic discussions.

Fed chairs have historically used their Jackson Hole speeches to deliver significant policy messages. For instance, Ben Bernanke 2010 argued for bond purchases (quantitative easing) to stimulate the economy, and Powell’s 2018 "Guided by the Stars" speech outlined his views on the natural interest rate. Last year, Powell delivered a brief but impactful speech, emphasizing the Fed's commitment to controlling inflation, even if it meant higher unemployment.

This year's speech is expected to have a different tone. With inflation showing signs of cooling and the job market softening, Powell might focus more on employment concerns. The US unemployment rate reached 4.3% in July, the highest since October 2021, increasing pressure on the Fed to act. Wilmer Stith, a bond portfolio manager at Wilmington Trust, believes Powell will likely avoid specific predictions for September but will emphasize the Fed's attention to the job market. "He wants to be transparent, but frankly, I don't think he knows yet," Stith said, suggesting the Fed's focus might shift to preventing further job market deterioration.

Powell may also discuss the "neutral" interest rate, which neither stimulates nor restricts economic growth, to clarify the Fed's approach to rate cuts. Luke Tilley, Wilmington Trust’s chief economist, expects Powell to frame the anticipated rate cuts as a cautious easing of monetary policy, not a full acceleration.

Former Kansas City Fed head Esther George anticipates that Powell might take a broader view, similar to his 2018 "Stars" speech, to reflect on recent economic developments and their implications for inflation and the labour market.

However, any definitive clues about September's decision might come later, with the August jobs report, set to be released on September 6, playing a critical role. Recent economic data has led traders to predict a quarter-point cut in September, with the odds now standing at 75%.