Investors are betting against Air Canada, Canada's largest airline

Investors are betting against Air Canada, Canada's largest publicly traded airline, anticipating higher operational costs and reduced demand post-pandemic will hinder its growth.

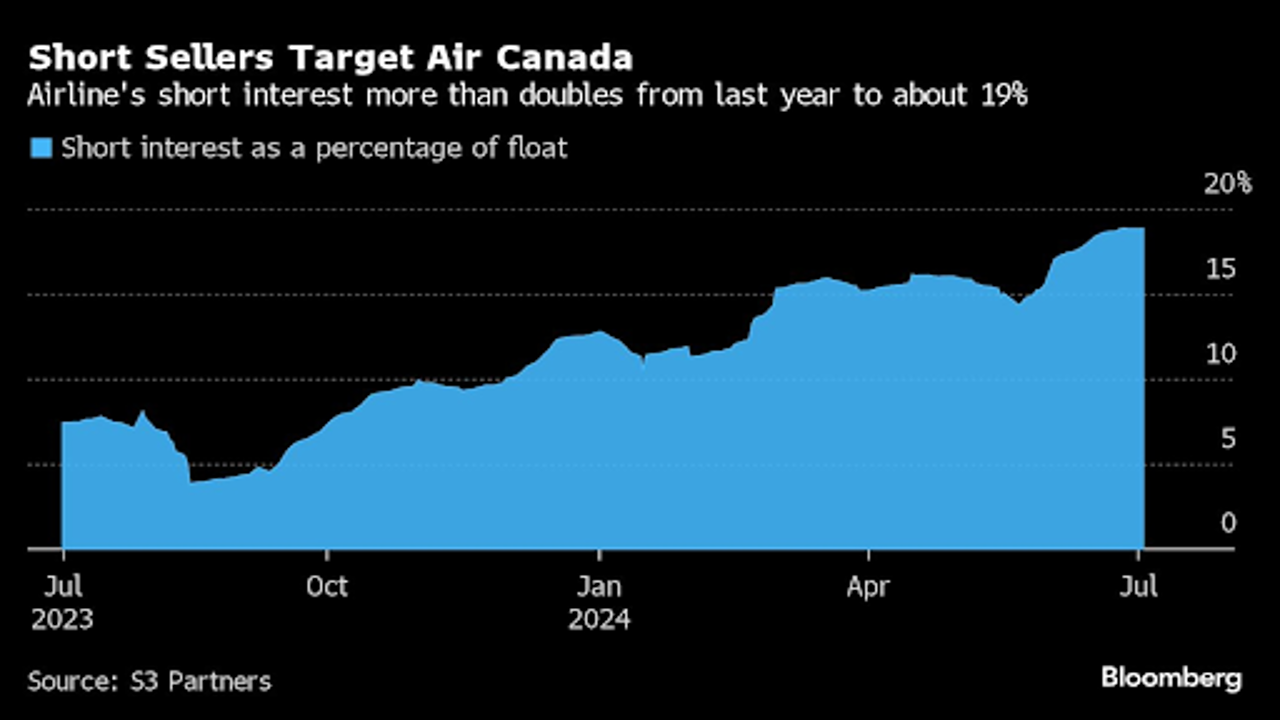

As of early July, short interest in Air Canada—measuring shares sold versus available stock—stood at nearly 19%, more than double the rate from a year ago. This surge suggests investors expect further pressure on shares as Canadians divert more income to cope with rising living costs. It's the highest rate since December 2021, when COVID-19 travel restrictions peaked at nearly 21%.

Air Canada's shares have dropped 4.7% this year amid economic challenges and industry headwinds, trading well below pre-pandemic levels that saw highs around $50.05 (US$36.74) in November 2019.

"Canadian investors are worried about a slowing economy and potential hikes in pilot wages once contract negotiations begin," remarked TD Cowen analyst Helane Becker via email.

Investors foresee a tough season ahead for airlines, facing shortages in aircraft and materials amidst inflation concerns that could deter passengers. Although inflation edged closer to the target of 2% with higher interest rates, it accelerated to 2.9% in May from 2.7% the previous month.

Preliminary data from Statistics Canada paints a sobering picture of economic growth, with GDP up just 0.1% in May, slower than the 0.3% growth seen in April.

Geopolitical uncertainties also dampen travel, noted Royal Bank of Canada economist Claire Fan. Despite increased domestic travel by Canadians, international tourist arrivals remain 10% lower than pre-pandemic levels.

Transat A.T. Inc., another Canadian aerospace firm, faces similar pressures. Since January 2020, its shares have plummeted 86%, mirroring Air Canada's 64% decline post-pandemic.

While Air Canada dominates Canada's airline market, its expansion is hindered by higher labor costs and growing domestic competition. Its market share has fallen to 48% from 54% in 2019, as rivals like WestJet Airlines Ltd. and Porter Airlines Inc. expand their routes.

Francois Duflot, aerospace analyst at Bloomberg Intelligence, highlights the intense competition within Canada's lucrative domestic market.

Unlike its U.S. counterparts, Air Canada has yet to settle a new labor agreement with over 5,000 pilots. With negotiations stalled since June 1, there's potential for strike action during peak summer travel, exacerbated by rising labor and fuel costs.

Morningstar's aerospace analyst Nicolas Owens suggests that Air Canada's struggles may reflect broader challenges in North American airlines, with many stocks potentially overvalued.