Stocks Fluctuate Amid Middle East Tensions, Dimming Market Optimism

Global stock markets faced uncertainty Monday as European equities reversed their earlier gains and U.S. futures declined. The shift followed stronger-than-expected U.S. job data on Friday, but growing concerns over escalating tensions in the Middle East have curbed investor optimism.

The Stoxx 600 index barely moved, while U.S. Treasury yields rose near 4% as investors reevaluated the chances of significant Federal Reserve interest rate cuts. Meanwhile, major currencies like the euro, British pound, and Asian currencies weakened against the U.S. dollar. Oil prices dipped, and despite the broader market's volatility, trading largely reflected optimism about the U.S. economy’s resilience.

Investors are cautious, balancing between encouraging signs from the U.S. economy and the growing risks from geopolitical tensions. The strong U.S. employment data from September, showing the highest job growth in six months, boosted expectations that the economy can continue growing without sparking inflation. This scenario, known as a “no landing” outcome, has led to expectations of a stronger dollar and less demand for safe-haven assets like gold and bonds.

However, the geopolitical landscape is volatile. The world is on edge following a recent missile attack by Iran, with investors waiting to see how Israel will respond. On Monday, Israel launched airstrikes targeting Hamas in Gaza, claiming it was in response to an immediate threat of rocket attacks planned to commemorate a major Hamas assault from the previous year.

Michael Brown, a senior research strategist at Pepperstone, pointed out in a note that while the U.S. job report keeps hopes of a soft landing alive, ongoing tension in the Middle East limits investors' confidence. "Geopolitical risks continue to keep sentiment in check, with many preferring shorter-term investments due to uncertainty,” Brown wrote.

U.S. stock futures reflected this unease, with a lower open expected following a 0.9% surge in the S&P 500 index on Friday, driven by the positive jobs report.

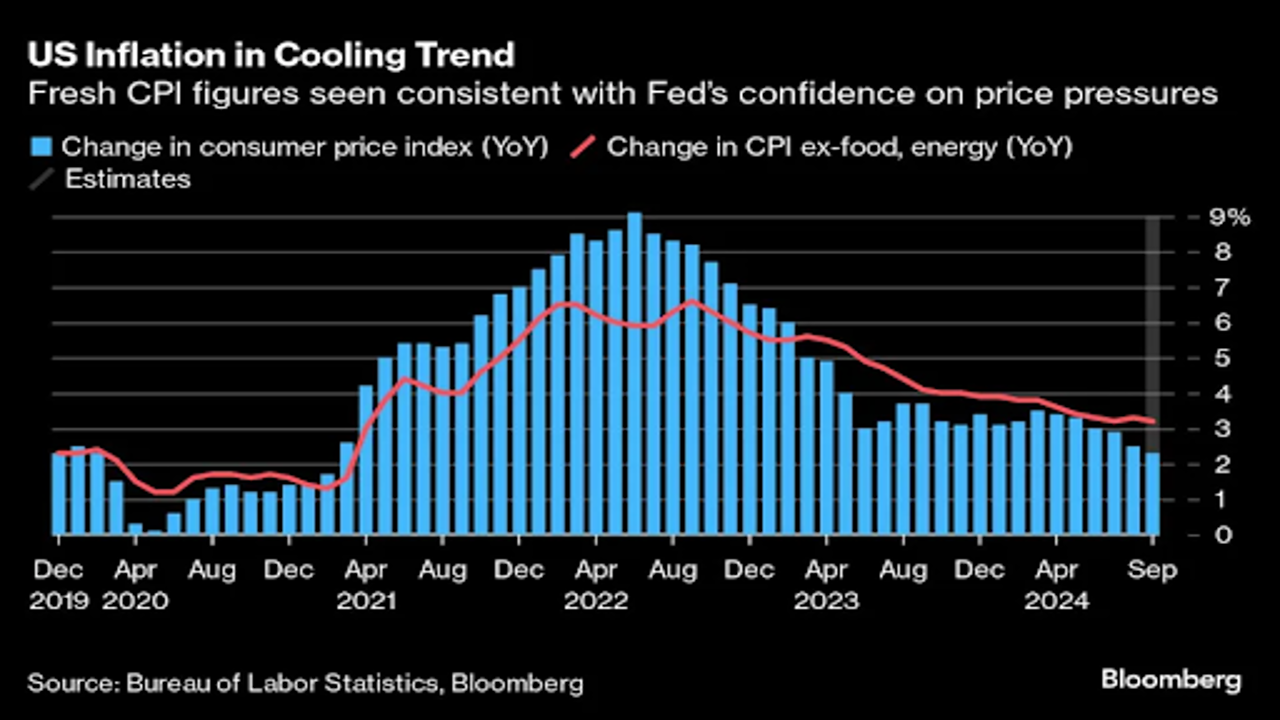

The strong labour market has also prompted analysts at Goldman Sachs to lower the probability of a U.S. recession to 15%, the long-term average. The analysts now anticipate a 25-basis-point interest rate cut by the Federal Reserve in November, following Friday’s data. Investors will also be watching closely as the Fed releases the minutes from its September policy meeting and U.S. inflation data for September is revealed. With inflation showing signs of cooling, experts predict that the Fed may opt for a smaller rate cut at their upcoming November meeting.

Other key events this week include a Euro-area finance ministers' meeting, speeches by several U.S. Federal Reserve officials, and inflation data from Brazil, Mexico, and Israel. Additionally, President Biden will begin an international trip this week to Germany and Angola, his first since announcing he would not seek re-election.

Key market indicators showed mixed reactions. European stocks were mostly flat, while U.S. stock futures dropped slightly. In Asia, the MSCI Asia Pacific Index gained 0.9%, and emerging markets saw a modest increase. Bitcoin and Ether showed positive movement in the cryptocurrency market, rising 1.5% and 1.9%, respectively. In commodities, Brent Crude remained steady, while gold prices fell by 0.3%.