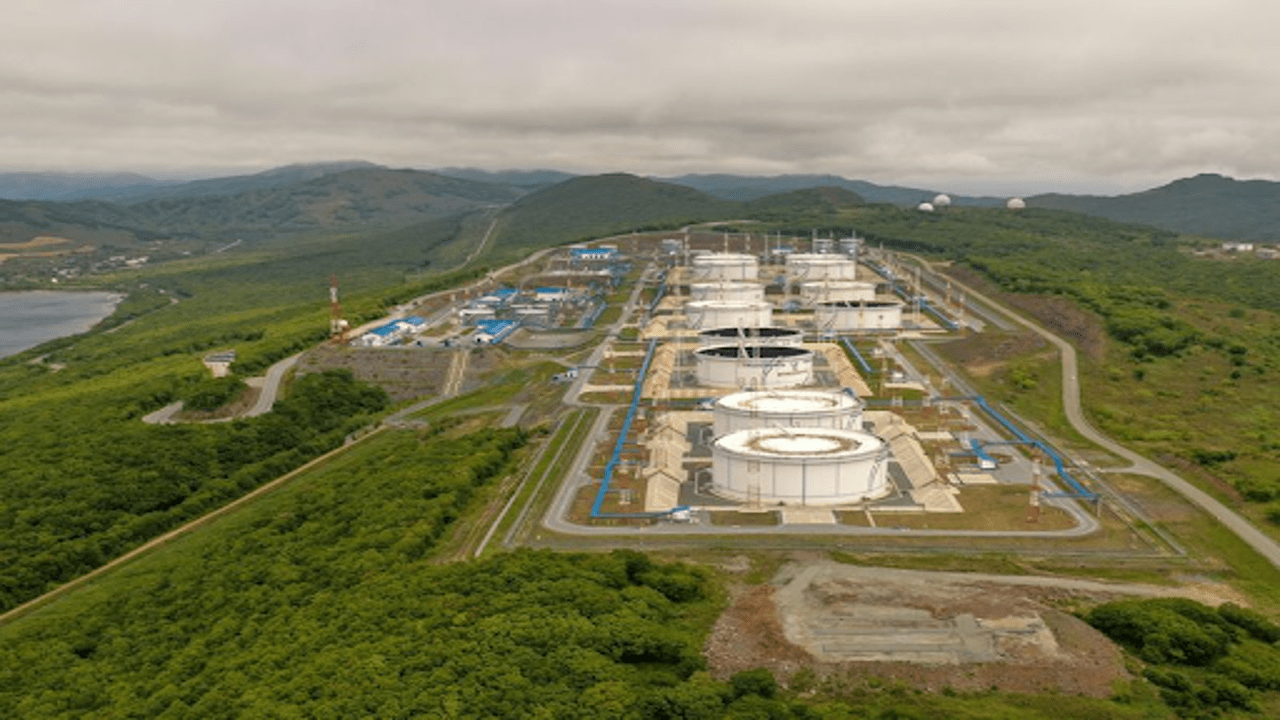

A view of the oil terminal at Kozmino, located near Nakhodka.

Oil prices saw a slight increase on Friday, influenced by signs of easing inflation in the United States, which is the world’s largest oil consumer. However, despite the uptick, Brent crude was on track for a weekly decline.

Brent crude futures gained 49 cents, or about 0.6%, reaching $85.89 per barrel by 6:30 AM GMT. Meanwhile, U.S. West Texas Intermediate (WTI) crude futures rose by 58 cents, or 0.7%, bringing the price to $83.20 per barrel. Both types of oil had seen gains in the previous two sessions, yet were still expected to finish the week lower.

Specifically, Brent crude was poised for a roughly 1% decrease over the week, breaking a four-week streak of gains. WTI futures, on the other hand, remained relatively stable over the same period.

Investor sentiment improved following a report released on Thursday that indicated a decline in U.S. consumer prices for June. This has led to increased expectations that the Federal Reserve might lower interest rates soon. Lower interest rates generally support economic growth, which in turn could lead to higher fuel consumption.

However, the market is still waiting for more concrete signs regarding future actions. Federal Reserve Chair Jerome Powell noted the recent positive trends in inflation but emphasized that more data is needed to justify any cuts in interest rates.

"While cooling inflation might encourage the Fed to consider easing policies sooner rather than later, it also points to ongoing economic challenges," explained Yeap Jun Rong, a market strategist at IG.

In addition to inflation data, indications of strong summer fuel demand in the U.S. have also contributed to rising oil prices. Data revealed that U.S. gasoline demand reached 9.4 million barrels per day (bpd) during the week ending July 5, marking the highest level for that week since 2019. Additionally, jet fuel demand has shown the strongest performance on a four-week average since January 2020.

"The market seems stuck in a range, influenced by contrasting factors. There are hopes for a demand recovery due to strong summer fuel consumption, but ongoing economic weaknesses and uncertainties continue to weigh on sentiment," commented Emril Jamil, a senior oil analyst at LSEG.

Strong demand for fuel has prompted U.S. refiners to increase their operations and draw from crude oil stockpiles. Last week, U.S. Gulf Coast refiners reported a net input of crude oil exceeding 9.4 million bpd, the highest level since January 2019, according to government data.

In summary, while oil prices are showing signs of life amid favorable inflation data and strong summer demand, Brent crude faces the challenge of a weekly decline. Investors remain cautiously optimistic, hoping for future interest rate cuts that could stimulate economic growth and, subsequently, fuel consumption.