Algonquin announced that the sale of its renewable energy business is expected to be finalized by late 2024 or early 2025.

Prospect Capital Corp., a private lender with a 20-year history, has responded to recent criticisms regarding its financial practices and reliance on individual investors. In a statement on its website this week, the company emphasized its strong access to diversified funding from a range of sources, including numerous bank lenders. The firm also defended its use of payment-in-kind (PIK) interest arrangements, which allow borrowers to pay interest with additional debt rather than cash, stating that these arrangements are appropriate in certain situations.

According to Prospect, the use of PIK interest can be a beneficial funding method for specific portfolio companies that are making investments in their businesses, especially when those investments are valued significantly above Prospect's initial cost. This approach, they argue, helps certain companies grow and maximize their potential.

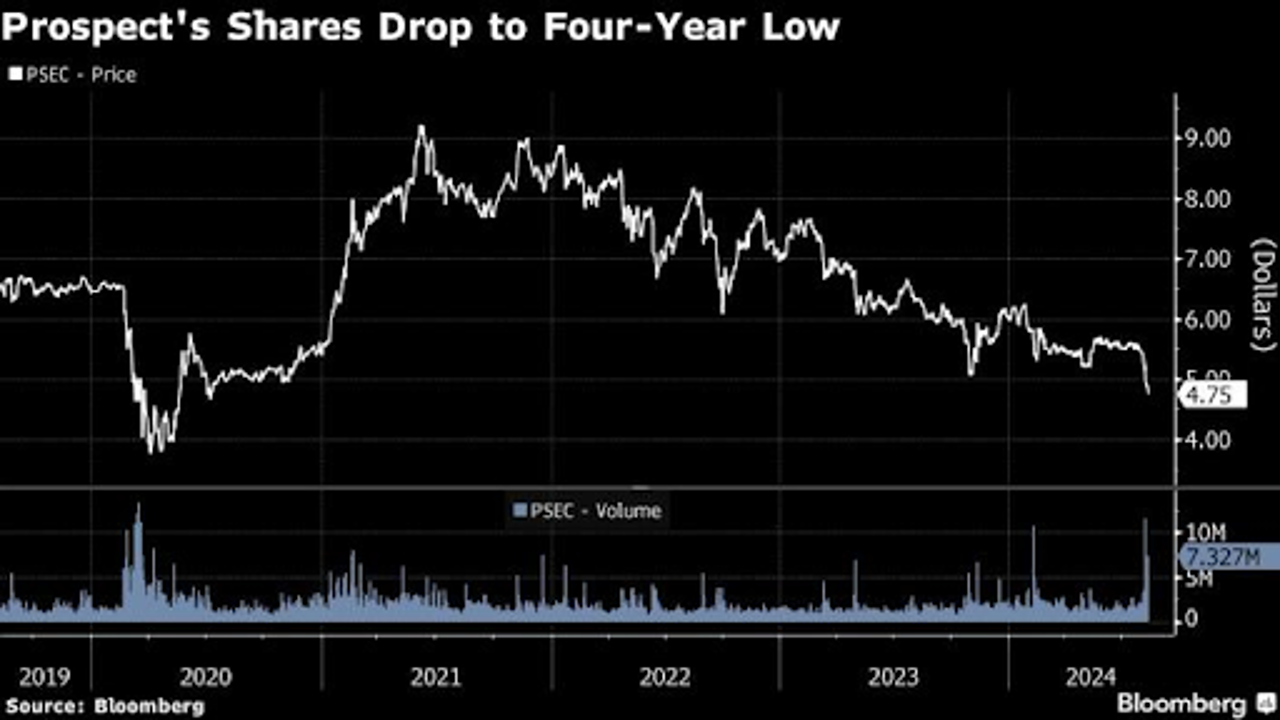

The company’s statement comes in the wake of a Bloomberg News report that raised concerns among analysts about an $8 billion private credit fund managed by Prospect. The report highlighted the risks associated with the firm’s use of PIK arrangements and noted that shares in the fund have dropped by 9% since the report's publication, reaching their lowest point in four years.

Analysts also expressed worries about Prospect's reliance on preferred equity and small bond sales to individual investors, suggesting that this approach is unsustainable. They pointed out that the company has continued to pay large dividends to shareholders despite a cash shortfall caused by its strained loan portfolio.

In its defence, Prospect pointed out that it has completed several institutional bond sales and has strategically delayed issuing more bonds in hopes of benefiting from lower interest rates in the future. The company also highlighted its rigorous screening process and diversified investment strategy, which extends to its real estate investment trust, which constitutes about 20% of the fund’s portfolio.

Prospect further noted that its fund has a very low share of non-accrual loans—loans on which lenders risk losing money—at just 0.4%, along with low leverage as of March. The fund has maintained investment-grade ratings from five credit rating agencies and has delivered superior total returns compared to its peers.

Despite the recent criticism and the drop in share prices, Prospect remains confident in its financial practices and the long-term sustainability of its funding strategies.