Top Wall Street and tech industry leaders head to Saudi Arabia for high-level meetings, despite ongoing conflicts in the Middle East.

Saudi Arabia is set to host top finance and tech leaders this week in Riyadh for the Future Investment Initiative (FII), a key summit intended to solidify the kingdom’s position as a global investment hub. Known as "Davos in the desert," the event will bring prominent figures from Wall Street and Silicon Valley as the region faces rising geopolitical risks, especially with the intensifying conflict between Israel and Iran. Despite these tensions, major names such as David Solomon from Goldman Sachs, Jane Fraser from Citigroup, Larry Fink from BlackRock, and tech leaders like Alphabet’s Ruth Porat and TikTok’s Shou Chew are expected to attend.

Saudi Arabia aims to diversify its economy beyond oil, driven by Crown Prince Mohammed bin Salman's Vision 2030. The prince is actively encouraging global investors to shift their focus from foreign markets to Saudi Arabia's ambitious domestic projects. This event underscores the nation’s desire to develop its technology sector, particularly in artificial intelligence (AI), and to reduce dependency on oil revenues. Deals worth over $28 billion are expected, with discussions on a new fund with Andreessen Horowitz that could reach $40 billion, marking Saudi Arabia’s commitment to AI. The kingdom also plans to announce a $10 billion hydrogen-focused company to establish Saudi Arabia as a global leader in clean energy.

General Atlantic will inaugurate its first office in Saudi Arabia, aiming to capitalize on regional opportunities, while two exchange-traded funds will launch in Riyadh, giving local investors a new channel to access Hong Kong stocks. This reflects Saudi Arabia's stronger ties with China, its largest trading partner. Several high-profile Asian representatives, including Hong Kong's Financial Secretary Paul Chan, are set to attend, reinforcing these ties and highlighting the kingdom’s ambition to establish stronger investment flows with Asia.

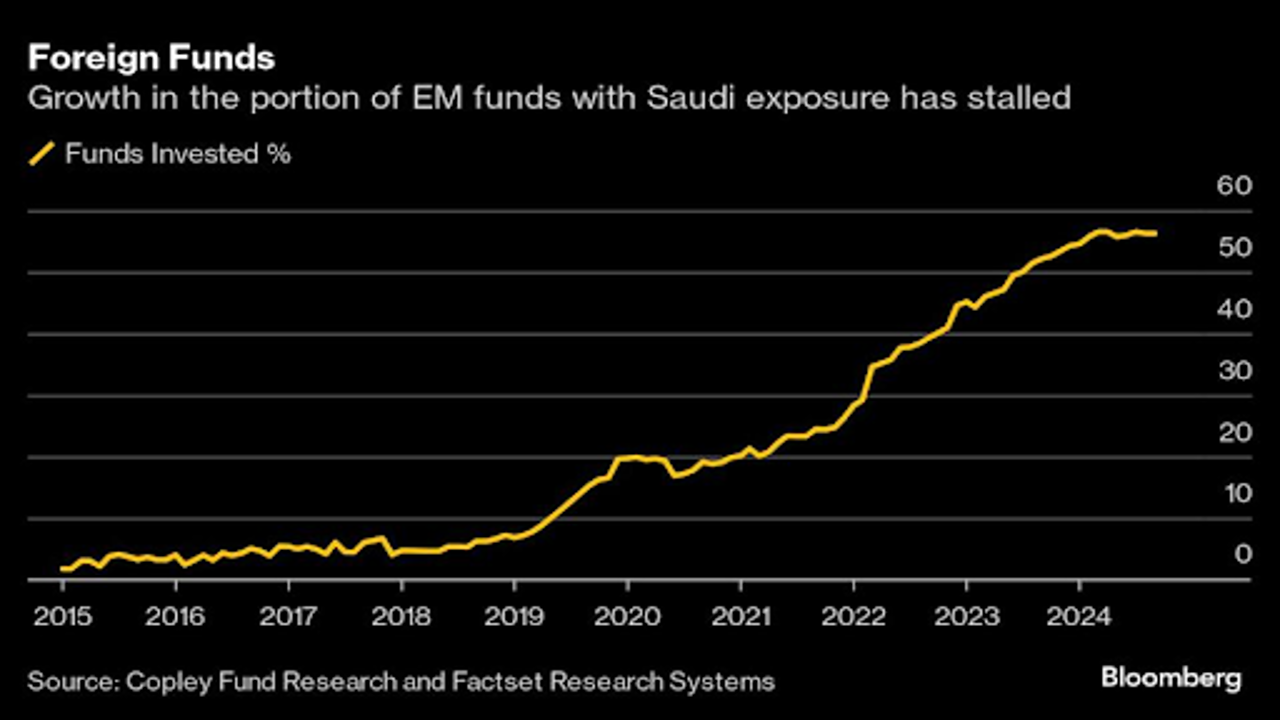

However, despite the summit’s high-profile lineup, the backdrop of regional conflict has cast a shadow over investor sentiment. Saudi Arabia's primary goal has been to foster regional stability, hoping to attract foreign investment and technology. But persistent unrest across the Middle East has made investors wary. This caution is reflected in the stalling number of emerging market funds with Saudi exposure, which rose initially but has recently leveled off as tensions between Israel and Iran heighten. Additionally, Saudi Arabia's stock market has seen a modest decline in international investment since March.

For the Crown Prince, the vision of Saudi Arabia’s transformation also comes with financial constraints. Although the kingdom commands nearly $1 trillion in sovereign wealth, projected deficits could delay some projects under Vision 2030. The Public Investment Fund (PIF), chaired by the Crown Prince, has been directed to focus more on domestic projects like Neom—a futuristic city initiative—raising concerns among global asset managers that less capital will be allocated abroad.

The Riyadh summit is fully booked, with around 7,000 attendees, reflecting robust international interest despite political uncertainty. This year’s attendance has surpassed last year’s turnout, which came right after the current regional conflict began. Richard Attias, CEO of the FII Institute, noted that upcoming U.S. elections are also on attendees' minds, as many believe the political landscape in the Middle East may be influenced by the outcome.

While the conflict weighs on investor confidence, the show goes on. Executives recognize the unique opportunities in Saudi Arabia, despite global and regional challenges.