Traders face unpredictable times as they analyze the outcomes of the French elections.

Investors are gearing up for a rollercoaster week after Marine Le Pen's far-right party clinched the first round of France's legislative elections. While the National Rally's win was expected, the focus now shifts to whether they can secure a commanding majority in the upcoming second round. This outcome could significantly impact policies on immigration and the euro, heightening market volatility.

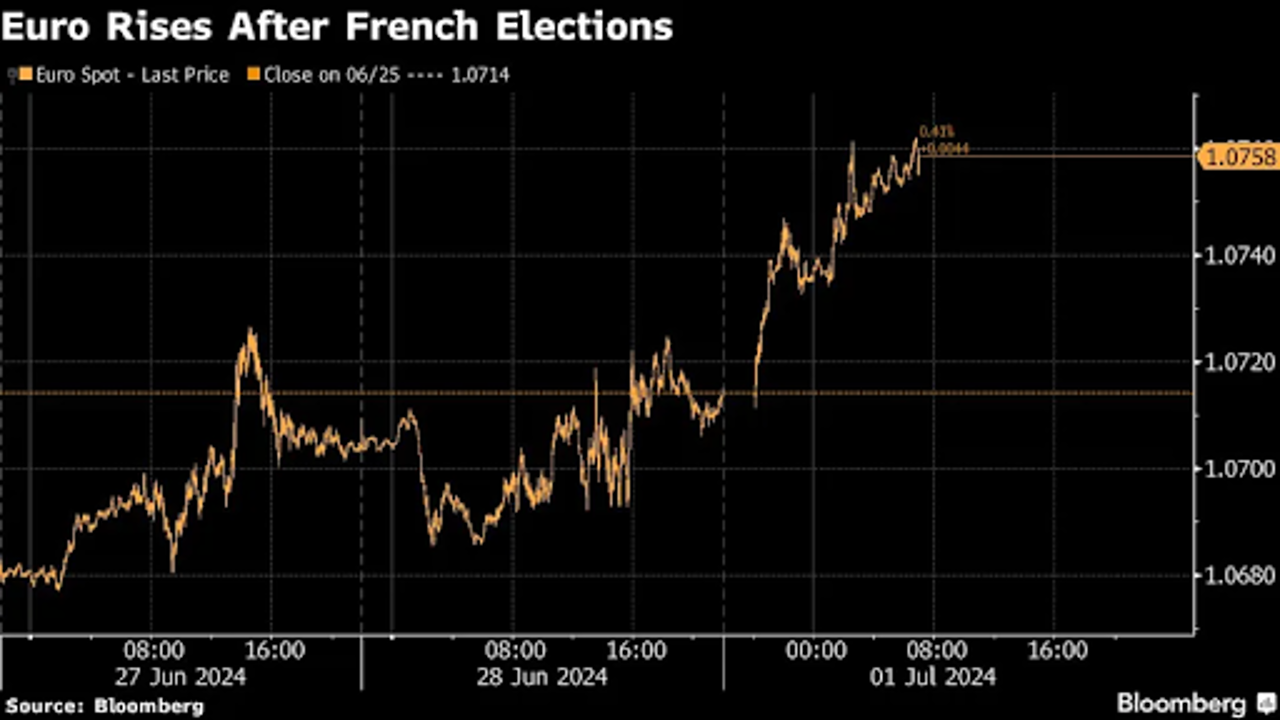

French bonds have seen their risk premium widen against German counterparts to levels not seen since 2012, and French stocks have slumped to five-month lows. Despite initial concerns, early trading saw the euro strengthen and stock index futures rise, providing some relief.

"Today's slight market relief may not last long as we brace for potential volatility ahead," warned Thomas Zlowodzki of Oddo BHF. Analysts predict French stocks to swing between gains and losses throughout the week.

With the National Rally securing 33.2% of the vote, the left-wing New Popular Front garnered 28%, and President Macron's centrist coalition trailed with 20.8%. Ahead of the next round, Macron's Renaissance party pledged strategic candidate withdrawals to bolster other anti-Le Pen contenders. Investor attention remains fixated on political alliances shaping up against extreme ideologies from both ends of the spectrum.

Market Experts Weigh In:

Vincent Juvyns, JPMorgan Asset Management: "Market reaction appears premature given the uncertainty ahead. Both fiscal policies present risks for France's economy and debt prospects."

Stephane Ekolo, TFS Derivatives: "Today's results align with expectations, providing a brief relief. Post-election, concerns may intensify, impacting French debt dynamics."

Peter Goves, MFS Investment Management: "Persistent uncertainties and three-way contests complicate predicting outcomes. Fundamental changes in France remain elusive."

Frederique Carrier, RBC Wealth Management: "Market adjustments are underway, with expectations of reduced reform momentum under Macron and heightened Eurozone tensions."

Alexandre Hezez, Group Richelieu: "Repricing reflects lowered risks of a left-wing alliance victory. Potential for central bloc involvement post-election also influences market sentiment."

Joachim Klement, Panmure Liberum: "Anticipating coalition negotiations to curb National Rally's gains. Continued volatility expected until post-second round outcomes."

Sonia Renoult, ABN Amro: "Duals between National Rally and left coalition could heighten investor fears, impacting market stability."

Wolf von Rotberg, Bank J. Safra Sarasin: "RN's potential absolute majority poses ongoing market risks, prompting concerns over legislative outcomes."

Daniel Varela, Piguet Galland & Cie SA: "Market adjustments reflected pre-election risks. Gridlocked governance scenario may offer relative market stability."

Valentin Marinov, Credit Agricole: "FX market awaits coalition developments to gauge Eurozone impacts. Premature to declare Eurozone stability amidst ongoing uncertainty."

Andrea Tueni, Saxo Banque France: "Market reactions priced in; no immediate downturn expected, but uncertainty looms, posing downside risks."

In summary, financial markets are on edge as French election outcomes unfold. The second round's results will dictate political and economic landscapes, influencing global market sentiments in the near term.