As more adults in North America turn to Ozempic and similar weight-loss medications, food companies are closely monitoring how this trend impacts their profits.

Raegan Sather, a marketing professional from Edmonton, has noticed a significant shift in her eating habits ever since she began using Ozempic, originally a diabetes treatment, for weight loss two years ago. Her grocery shopping now revolves around fresh produce, lean meats, and high-protein foods, avoiding the snack aisle altogether. The medication has completely curbed her snacking habits, eliminating her evening popcorn ritual entirely.

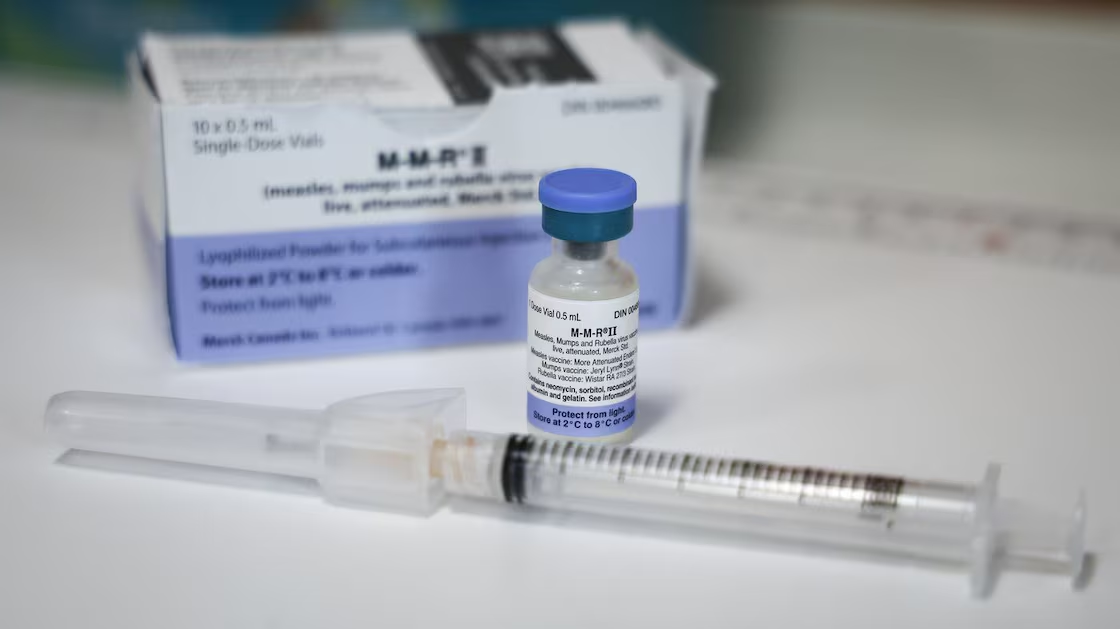

As more adults across North America turn to injectable drugs like Ozempic and Wegovy for weight management, food companies are closely monitoring how this trend affects consumer behavior and their sales strategies. Nestle, for instance, has launched a range of prepared meals targeted at individuals using GLP-1 drugs such as Ozempic and Wegovy. Similarly, executives at Danone and Coca-Cola are promoting high-protein, low-sugar products tailored to appeal to these medication users.

Despite these efforts, the effectiveness of such strategies remains uncertain. "Even if you're using a weight-loss drug, it's still up to you how you manage your dietary responses," emphasizes Sather.

Recent surveys indicate a significant uptake of GLP-1 drugs in Canada and the United States. A survey by Dalhousie University suggests that between 900,000 to 1.4 million Canadians are currently using these drugs. In the U.S., a Gallup poll found that 15.5 million adults have used injectable weight-loss drugs, with projections indicating that nine percent of American adults will be on GLP-1 drugs by 2030.

Originally designed to treat diabetes, Ozempic has gained popularity for its unintended effect on weight loss. Dr. Daniel Drucker, involved in the drug's development, discusses concerns regarding its off-label use and its impact on popular culture.

Robert Carter, a food industry analyst, notes that about 15 to 20 percent of the population tends to adopt new diet trends eagerly. For companies like Nestle and Coca-Cola, understanding these shifts in consumer behavior is crucial. However, unlike fad diets such as South Beach or Atkins, GLP-1 drugs significantly suppress appetite and cravings, leading to reduced overall food intake.

The rise of Ozempic aligns with broader health and wellness trends in the food industry. Carter observes that while companies were already shifting toward healthier products, the introduction of these drugs has accelerated this transformation.

Despite concerns, Carter believes that companies should not be overly worried. He views this as part of the ongoing evolution in consumer purchasing behavior related to food choices.

Nestle's introduction of a product line in the U.S. aimed at GLP-1 medication users is meant to complement their weight management efforts. The menu includes items like pizzas, sandwich melts, and high-protein pasta bowls priced at $5 US each. However, registered dietitian Abby Langer warns against overreliance on ultra-processed foods, suggesting they could contribute to weight gain. She advocates for balanced meals that provide essential nutrients such as protein and fiber.

Langer also points out that individuals using these drugs might unintentionally miss out on vital nutrients due to reduced overall food consumption.

Despite the marketing hype on social media, medical experts caution that Ozempic is not a miracle solution for weight loss. Sather echoes this sentiment, emphasizing that healthy eating remains pivotal for the drug's effectiveness.

"This is not a magic drug," she emphasizes. "It's simply a tool, and making informed decisions is crucial for it to work effectively."