Photo from CTV News

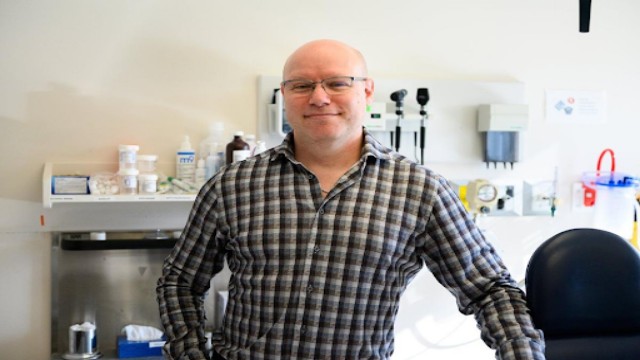

Health Minister Mark Holland affirms the government's commitment to implementing proposed capital gains tax changes despite objections from the Canadian Medical Association (CMA). While acknowledging doctors' contributions, Holland asserts the fairness of the changes, emphasizing the need to address societal disparities.

The budget proposes increasing the inclusion rate on capital gains from 50 to 67 percent for individuals earning over $250,000 in capital gains annually, and for all corporations and trusts, without a minimum threshold. This adjustment aims to generate over $19 billion in revenue over the next five years. However, doctors express concerns about the potential impact on their retirement plans, particularly those who incorporated their medical practices.

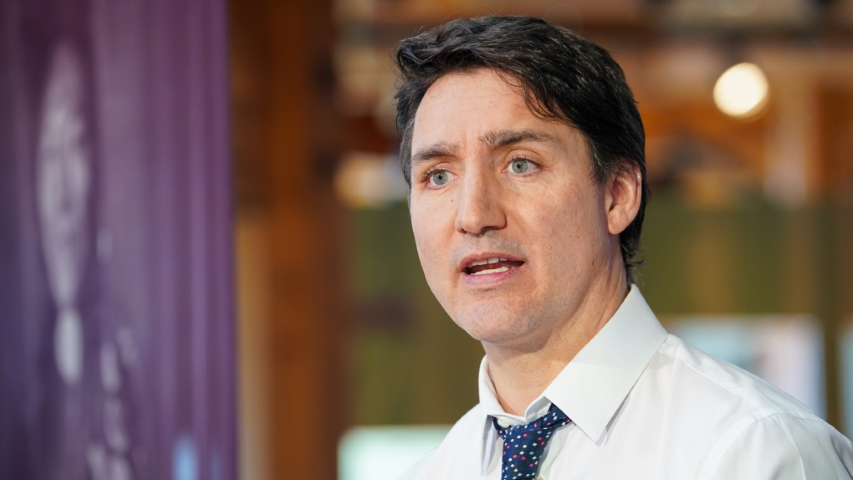

Prime Minister Justin Trudeau defends the changes as a matter of fairness, while Dr. Kathleen Ross of the CMA describes it as a blow to physicians who already feel demoralized post-pandemic. Ross highlights that many doctors were encouraged to incorporate their practices years ago as a retirement savings strategy. The CMA estimates that about eight percent of doctors' retirement savings could be affected by the tax increase, which they deem significant.

Approximately two-thirds of Canada's physicians are incorporated, according to the CMA. Holland, responding to concerns about doctors being disproportionately burdened, emphasizes his appreciation for their work while reiterating the government's aim to address wealth inequality. He stresses that the intention behind the tax increase is to ensure that those with substantial wealth contribute more to reducing societal disparities.

When asked whether doctors should retain more of their earnings, Holland acknowledges their hard work but underscores the importance of societal values. He suggests that addressing wealth discrepancies is crucial for creating a more equitable society.

Contrary to concerns raised by doctors, Holland asserts that there is misinformation about the impact of the capital gains tax changes. He highlights that despite the increase in the inclusion rate, incorporation still offers various tax benefits. Holland expresses a willingness to collaborate with doctors to ensure fairness in the tax system and to invest in healthcare.

According to the Canadian Institute for Health Information, the average gross payment per physician in Canada in 2022 was $357,000. However, incorporated physicians must cover staff salaries and practice overhead from this amount.

Holland acknowledges doctors' concerns but emphasizes the importance of investing in healthcare and addressing societal disparities. He reiterates the government's commitment to working with doctors to ensure that the tax system is fair and beneficial for all stakeholders, including patients.

In summary, Health Minister Mark Holland defends the government's decision to proceed with proposed capital gains tax changes despite objections from doctors. He emphasizes the need to address wealth inequality and reaffirms the government's commitment to collaborating with doctors to ensure fairness in the tax system and investment in healthcare.